- Home

- /

- Make sustainability profitable and profitability sustainable

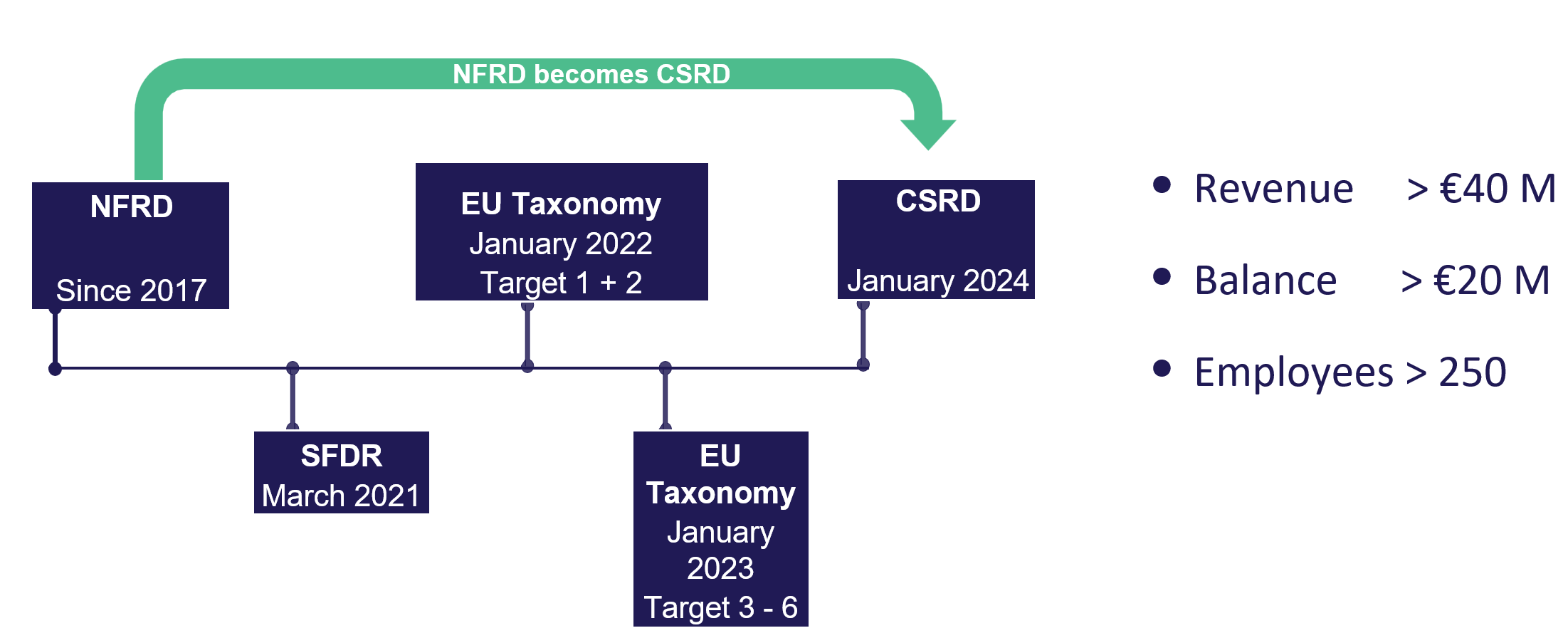

With the new Corporate Sustainability Reporting Directive (CSRD) impacting approximately 50 000 companies across the EU – significantly more than the 11 000 covered by the NFRD – sustainability reporting is quickly becoming a hot topic in Baltic business communities.

As deadlines draw near, it is crucial to take note of the following dates:

At several recent ESG conferences I recently attended, “compliance” was cited as the primary motivation for implementing sustainability reporting. This highlights a disconnect between shareholders and business owners, who prioritize financial value and profit, and sustainability officers responsible for enacting policies and setting goals. Navigating internal company politics can be challenging when compliance is viewed merely as an additional expense.

However, there is potential for a different approach to reshape the way businesses perceive sustainability reporting.

I’d like to present a perspective on how businesses can reframe ESG reporting, shifting it from being perceived as a compliance-driven expense to an opportunity for gaining a competitive edge and driving profitability.

The Return on Sustainability Investment (ROSI) methodology

The NYU Stern Center for Sustainable Business has introduced the Return on Sustainability Investment (ROSI) methodology), providing companies with a comprehensive five-step framework to maximize the potential of their ESG initiatives:

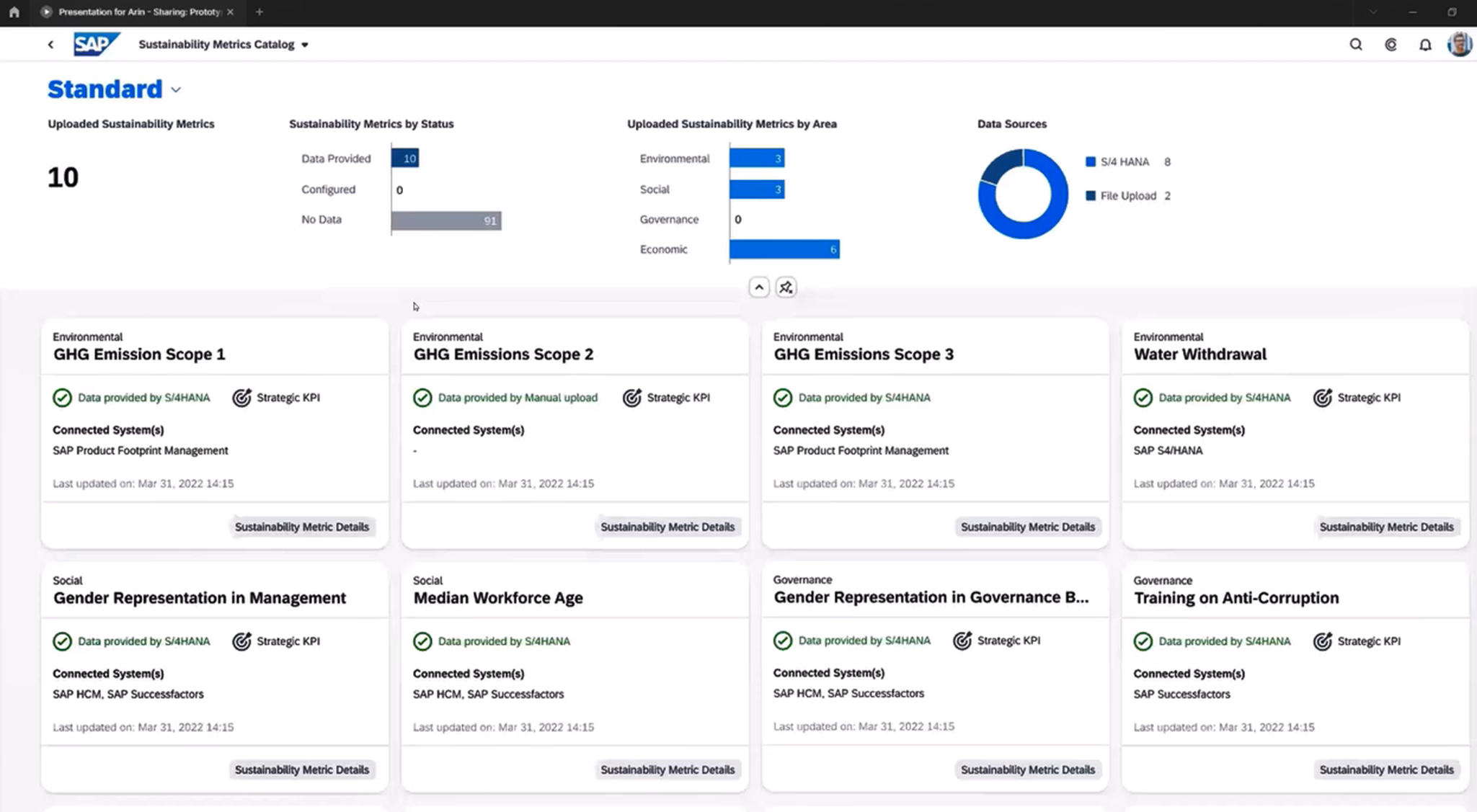

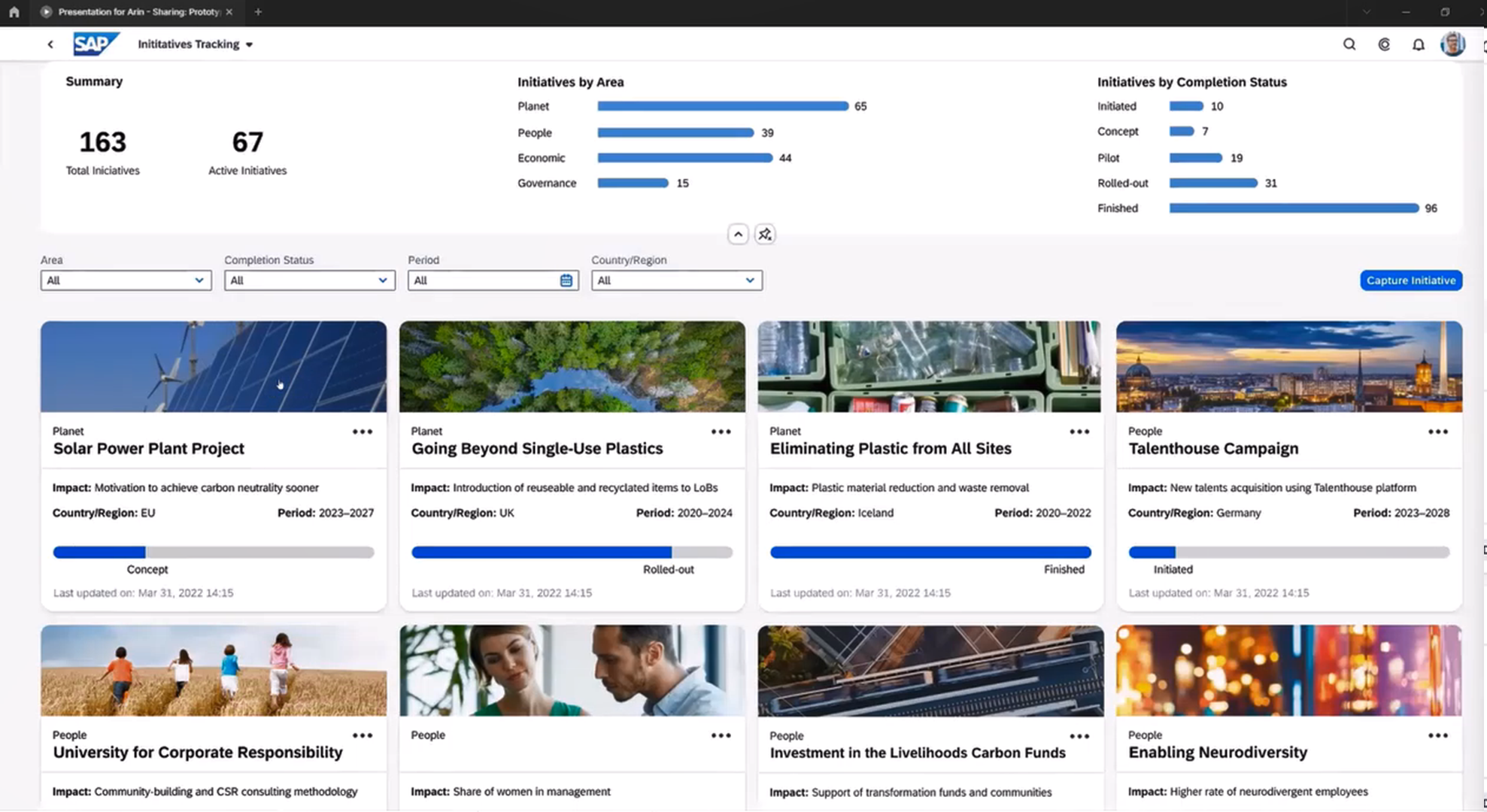

As the economic impact of sustainability becomes clearer, companies face increasing pressure to track and report payoffs. Tools like SAP Sustainability Control Tower can help identify the financial returns of sustainability activities, engaging CFOs in decision-making and transforming ESG activities from expenses into profit generators.

Let’s take a pragmatic look at one of the solutions we are delivering ESG projects – SAP Sustainability Control Tower which engine is based on SAP Profitability and Performance management with extended functionality.

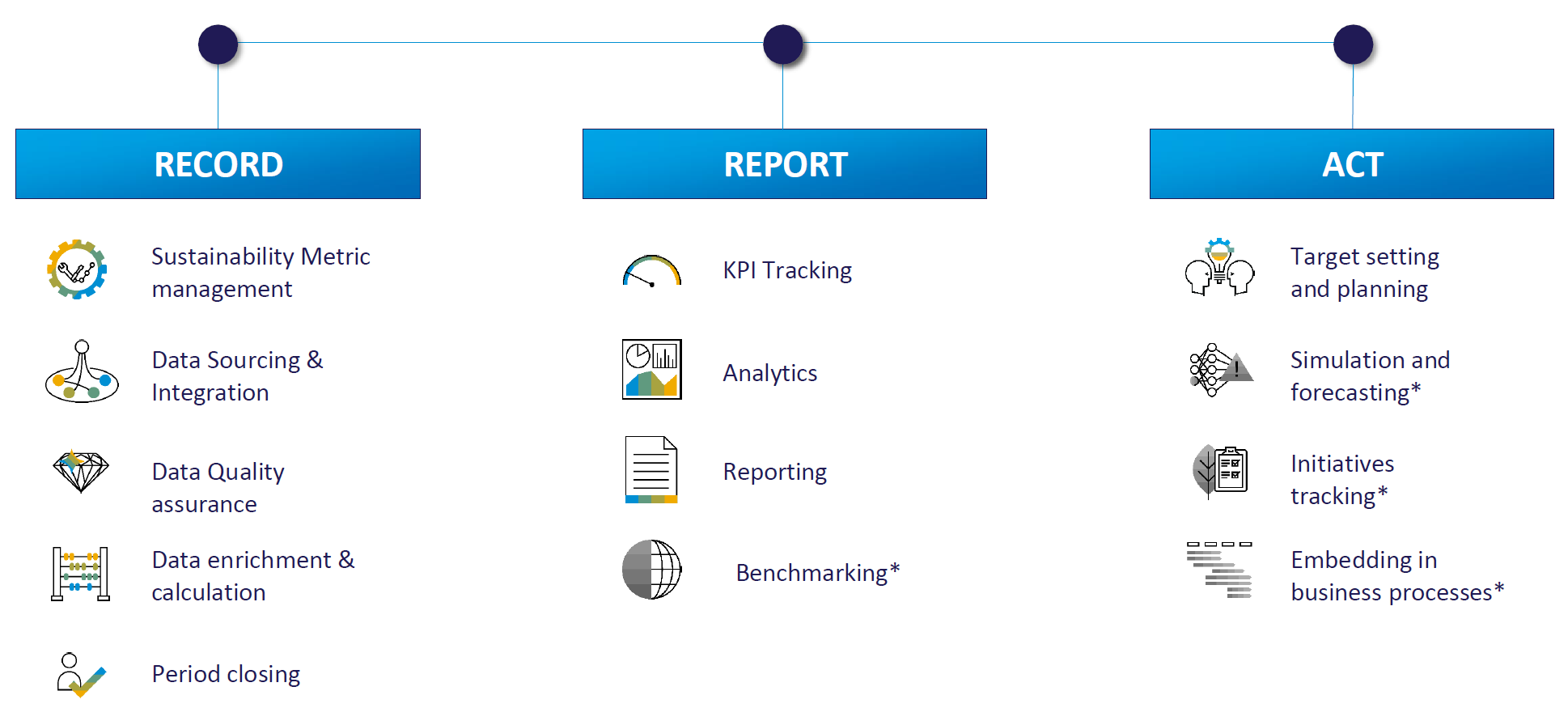

SAP’s sustainability management and ESG solutions enable businesses to harness the power of data, driving holistic steering and robust, auditable reporting. The solution consists of three main pillars: Record, Report and Act. Let’s deep dive about each of them.

RECORD: Actuals instead of averages

SAP allows you to connect any data source or begin with manual data entry. Data collection automation streamlines the process using pre-built integrations, APIs, or file imports.

Once you have the necessary data, enhance and validate it through automatic checks or approval workflows to ensure audit-ready results.

Predefined data models and calculations, including ready-to-use EU Taxonomy and CRSD data models, help harmonize, allocate, and calculate granular sustainability KPIs following established structures from finance, HR, and operations.

REPORT: Audit-ready ESG metrics

After building a solid data foundation, monitor and understand your sustainability performance in relation to finance, HR, real estate, and operations as frequently as your internal business decisions require.

As ESG standards evolve, your data foundation can easily adapt to new, changing requirements. Existing reports already include the most common standards like GRI, TCFD, EU Taxonomy, and more, with pre-defined sustainability metrics. Share and cascade performance data to responsible leaders, analyzing it at the appropriate granularity for business units, departments, and locations.

ACT: Sustainability embedded in business processes and simulations

Set and track actionable targets, gaining insights into core processes, forecasting outcomes, and analyzing what-if scenarios. For example, assess the impact of a new initiative on emissions and its effect on product profitability.

This approach allows you to evaluate various alternatives, considering factors such as emissions, product and service profitability, and overall financial returns. By analyzing multiple scenarios, one can identify the most promising initiatives, make data-driven decisions, and prioritize investments that align with their sustainability goals and business objectives, such as profitability.

By adopting a new perspective on ESG reporting (i.e., adopting the Return on Sustainability Investment methodology), businesses can shift their focus from merely fulfilling compliance requirements to seizing opportunities for driving profitability and gaining a competitive edge (suggest you to read also HBR article “Want to Excel in ESG? Craft a “Green Ocean” Strategy).

By utilizing tools like SAP Sustainability Control Tower, companies can transform ESG activities from expenses into profit generators thus making profitability sustainable.

Additionally, businesses can leverage full potential of SAP Profitability and Performance Management (PaPM) to implement activity-based costing, further optimizing their financial strategies. As an example, in this video “Luminor Bank Customer Success Story” our customer Luminor Group explains how their achieved cost-effective management of finance and business processes.

Interested in test-driving SAP Sustainability Control Tower?

Please don’t hesitate to reach out, and I would be delighted to guide you through the process.